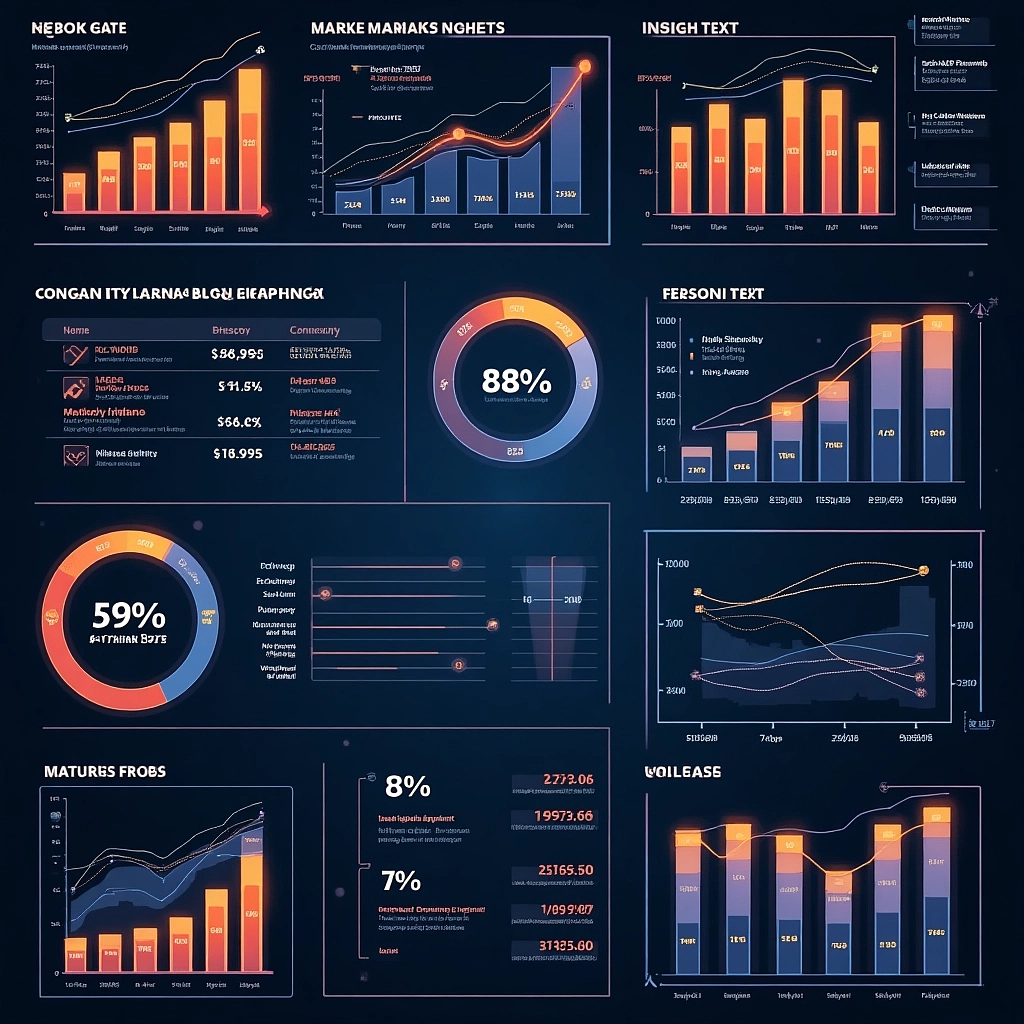

The landscape of the housing market has undergone a significant transformation over the past few years, with one key factor being the fluctuating mortgage interest rates. A closer look at the data reveals that the monthly principal and interest payments on mortgages have risen by a staggering 78% since 2021, driven by interest rates jumping from historic lows to highs in just a short span of time.

The significant increase in mortgage interest rates has had far-reaching consequences for the housing market as a whole. Persistently higher rates have not only served as a deterrent to potential new homebuyers, but also played a crucial role in reducing the overall supply of homes available on the market. This is because higher interest rates make it more expensive for homeowners to refinance or purchase new properties, leading to a decrease in demand and ultimately a contraction in the supply of homes.

The latest data from mortgage lenders reveals that the 30-year fixed-rate mortgage has jumped up to 6.78% this week. This increase marks yet another surge in interest rates, which have been steadily rising over the past few months. According to Freddie Mac's latest survey, the continued strength in the economy has driven mortgage rates higher once again this week.

The impact of these rising interest rates on the housing market is undeniable. As prices rise and affordability decreases, many potential homebuyers are forced to re-evaluate their options or put their plans on hold indefinitely. This can have a ripple effect throughout the entire market, leading to decreased demand and a slower pace of sales.

For more on this topic, see our article on Related Article.